Monopoly tycoon download full version free. $30 copay After deductible: GW – 60% Employee – 40% Emergency Room After deductible: GW – 80% Employee – 20% After deductible: GW – 80% Employee – 20% After deductible: GW – 80% Employee – 20% After deductible: GW – 80% Employee – 20% Home Health Care Up to 100 visits per calendar year 80% after. Neo geo roms snow bros. $30 copay $50 copay $30 copay $50 copay Diagnostic Lab & X-ray 20% coinsurance. 100% after deductible Prescription Drugs (after deductible). $30 Copay: Specialist Visit: $60 Copay: Laboratory Outpatient and Professional Services: 30.00% Coinsurance after deductible: X-rays and Diagnostic Imaging: 30.00% Coinsurance after deductible: Diagnostic Imaging such as MRIs, CT, and PET scans: 30.00% Coinsurance after deductible: Deductible - Family: $2700 per group: Out-of-Pocket Maximum. Copay After Deductible: Everything You Need to Know. An example of paying coinsurance and your deductible would be if you have $1,000 in medical expenses and the deductible is $100 with 30 percent coinsurance. You would pay $100 along with 30 percent of the remaining $900 up to your out-of-pocket maximum, which would be the most you would.

$30 Copay With Deductible

What Is Copayment With Deductible

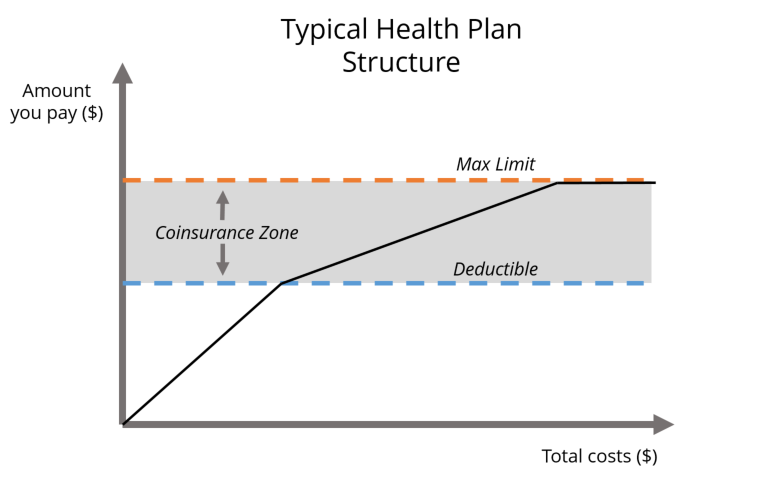

Copays for High Deductible Health Plans (HDHPs) work a little different from other types of plans. Typically with HDHPs, employees must meet their deductible before the carrier will pay for any services other than preventative care.

What Is 50% Coinsurance After Deductible

This means that if you have an HDHP with a $3,000 deductible and a $20 copay for primary care, you may have to meet the entire deductible before the copay will apply. This is why HDHPs are often paired with HSAs - the pretax contributions help offset the $3,000 deductible amount that you'll pay out-of-pocket before your copay can apply.